Compound Interest, Part 3: History’s Best Double Agent

This is the third installment of a 5-part series examining the massive impact compound interest can have on your journey to financial freedom.

In part two of this series we reviewed how the power of compounding accelerates over time and can serve as your rocket to riches, making it possible to break the sound millionaire barrier by simply saving and investing $46.00/week over a period of 50 years.

In today’s article we’ll be detailing how compound interest can actually work AGAINST you by going undercover and acting as a double agent to thwart your financial goals.

Setting The Stage

The annals of history are filled with the legacies of brave and talented individuals who put their lives on the line to serve for causes they believed in. Perhaps none more so than those who chose to go deep undercover in the form of double agents to work (at least ostensibly) with and for the enemy.

The term “double agent” probably brings a single name to mind for most of us today – that of Bond. James Bond. What many may not know is that Ian Fleming’s fictional MI6 Agent 007 was actually inspired by and based on a real double agent – arguably the best in history.

The Real-Life James Bond

Intelligent, multi-talented, confident, suave, debonair, and deadly, Yugoslavian lawyer Dusan “Dusko” Popov served as a British double agent during World War II and as Fleming’s inspiration for the famous 007 series based on an in-person encounter.

Popov’s story starts with being pressed into service by the Abwehr, Nazi Germany’s military intelligence agency. Due to his opposition to the idea of the Third Reich, Popov then approached Great Britain and offered his services as a double agent, which were accepted.

He quickly became one of Nazi Germany’s top intelligence assets by providing them with disinformation that appeared to be valuable, thanks to his British connections. Not long after, he became Great Britain’s top agent as well by dint of his status behind enemy lines.

Deep Cover

Popov could speak five languages and artfully navigate any and all social environments, yet was trained to kill silently with his bare hands. At one point, his cover was so deep that he was using three different code names – ‘Dusko’, ‘Ivan’, & ‘Tricycle’ – to report to six different intelligence agencies belonging to three different nations:

- The Abwehr, Nazi Germany’s military intelligence

- The Gestapo, Nazi Germany’s secret state police

- Sicherheitsdienst, the Nazi Party’s intelligence service

- MI6, Great Britain’s foreign intelligence

- MI5, Great Britain’s domestic counter-intelligence

- The American FBI

Impact On World War II

If managing a half-dozen different identities and reporting relationships in life-or-death situations doesn’t speak volumes alone as to Popov’s talent, consider his accomplishments:

- Masterminded Plan Midas, a massive money laundering scheme which drained the Nazi war-chest of the equivalent of $5 million dollars and which later served as the basis for the casino scene played by Daniel Craig as 007 in Casino Royale.

- Served as one of the primary assets employed in Operation Fortitude, a successful, far-reaching British misinformation campaign which convinced Nazi forces that the Normandy invasion would take place in a French location other than the D-day beaches.

- Warned the FBI of a pending attack on Pearl Harbor months before it took place, after he was sent by Germany to the U.S. to create an undercover spy network and scope out Pearl Harbor defense details. This fact was buried by the U.S. government and only came to light after British intelligence files were declassified decades later.

But I digress. After all, you’re here to learn about financial freedom, not World War II for gosh sakes. So what’s with the history lesson?

Compound Interest: A Powerful Agent

I reference Popov’s story* not only because doing so pleases my inner military history junkie, but also because there are stark parallels to a huge piece of the personal finance puzzle – namely, compound interest.

We saw in Your Rocket To Riches that if the engines of compound interest are ignited, it can serve as a powerful force working on your behalf – just like a highly-skilled special agent.

The compounding power of interest is like a machine. It never tires. It’s on the job 24/7/365 – it never sleeps, celebrates holidays, or goes home for the weekend. It’s constantly at work, grinding away. And just like Dusko Popov, it always delivers.

Managing Your Intelligence Network

Sometimes all a 007 needs in a critical moment is a little more time to complete his assigned mission. Give your compound interest special agents more time to work and what happens? Massively improved results, as we saw in part 2 of this series.

Growing an intelligence network through recruiting additional agents often obtains faster and better results. Employ a higher interest rate, and the same holds true in the world of finance.

Support your compound interest special agents with more tools of the trade (ongoing contributions) with which to employ their craft? This is where results really scale up, as illustrated in the “Breaking The Sound Millionaire Barrier” section of part 2.

The Need For Counter-Intelligence

As the director of your finances, your job is to ensure that you give these special agents of compound interest working on your behalf enough time to do their job, that you employ enough of them to achieve your goals, and that you equip them to the best of your ability.

However, your job doesn’t end there. You must also warily ensure that this network of special agents works FOR you rather than AGAINST you. That’s right – make sure compound interest doesn’t switch sides and start working against you in the form of a classic double agent.

Compound Interest: Your Undercover Enemy

In a savings or investment account, compound interest works tirelessly on your behalf to further your interests. However, it can quickly turn from trusted asset to undercover enemy if you purchase something on credit, whether that be in the form of a credit card, paycheck advance, student or auto loan, or mortgage.

In these situations, all the power of compound interest is working for the companies or institutions from which you borrowed money, but AGAINST you.

For sake of illustration, let’s use a basic compound interest calculation similar to those in part 2 of this series. A $1,000 starting balance, 16.15% interest rate compounded annually, 50-year time horizon, and no ongoing contributions nets us the below results from our familiar compound interest calculator:

- After 10 years – annual interest = $621.36, account balance = $4,468.79

- After 20 years – annual interest = $2,776.74, account balance = $19,970.20

- After 30 years – annual interest = $12,408.75, account balance = $89,243.11

- After 40 years – annual interest = $55,452.38, account balance = $398,810.74

- After 50 years – annual interest = $247,806.28, account balance = $1,782,210.47

From a mere $1K to a whopping $1.78 million buckaroos in 50 years. This is compound interest at work – the best in the biz. But what happens if your prized special agent becomes compromised and begins working for your opponents, instead?

Betrayal: The Compound Interest Double Agent

Let’s say you over-spent last Christmas and are carrying this same $1,000 balance on your credit card, which has an interest rate matching the national average of 16.15%. If you made no payments, compound interest would grow the balance on your credit card to match the same numbers listed above. After 50 years, you’d be looking at total debt of $1.78 million. Yikes.

This is what can happen when the power of compound interest is employed AGAINST you in the form of debt, rather than FOR you in the form of savings.

This is how the compounding power of interest that you thought you knew can act as a powerful double-agent undermining your goals, just as Dusko Popov undermined the unsuspecting Nazi regime in World War II.

Decrypt Your Credit Card Statement

In the scenario outlined above, you’re not going to go without making any payments on your credit card for 50 years. You have a minimum payment to make, after all.

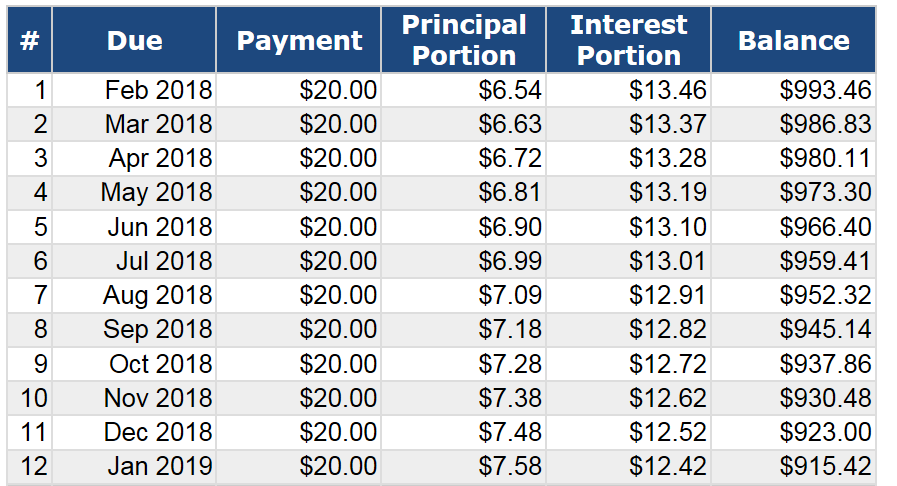

Because cash is still tight, let’s say you’ll make a basic $20/month payment for now. Using this credit card payoff calculator, we find that just $6.54 (32.7%) of your first $20.00 payment serves to reduce your $1,000 balance, with the remaining $13.46 lost to interest:

The above payment schedule indicates that after you’ve made your first twelve $20 payments totaling $240, your balance has only decreased by $84.58 ($993.46 – $915.42). The remaining $155.42 or 64.8% has been lost to interest!

In this case, compound interest has been compromised and is working against you for its true handler, the credit card company. As you can see from the above table, you’ll have to fight against it every step of the way to pay this balance down.

Doing so at a rate of $20.00/month will take seven years and will come at a cost of $671.87 in interest payments, per this loan calculator. This is 2.8 years (34 months) longer and $671.87 more than if interest were not a factor.

Blow The Cover Of Double Agent ‘Mortgage’

Let’s look at one more scenario illustrating to what extent compound interest can potentially sabotage your efforts to become debt-free, build wealth, and achieve financial freedom.

Consider a 30-year mortgage, with a $100,000 principal and a 4% interest rate. Sounds pretty innocuous, right? Let’s decipher this account to find out whether this holds true.

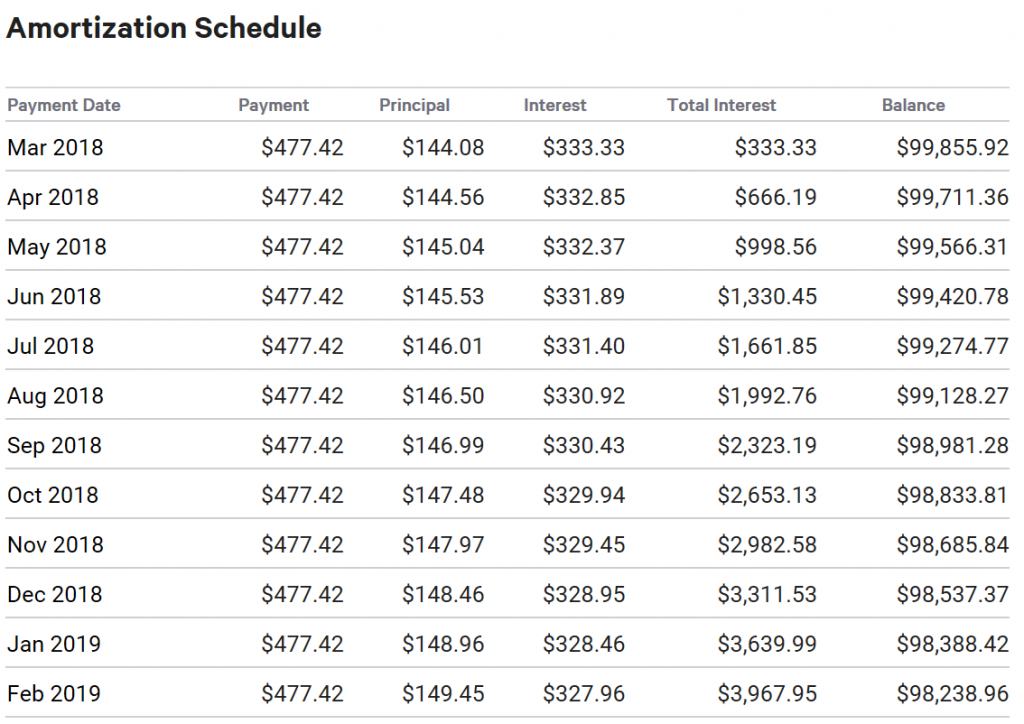

Using this loan amortization calculator, we see that the fixed monthly payment is just $477.42. That sounds pretty affordable. However, upon drilling into the payment schedule we find that $333.33 (69.8%) of our very first payment is lost to interest:

The above schedule indicates that after making our first twelve $477.42 payments totaling $5,729.04 over the course of the first year, our balance has only decreased by $1,761.04.

What happened to the remaining $3,967.95 or 69.3%? Siphoned off in the form of interest, an accomplishment that would make even the mastermind behind the Plan Midas heist proud.

Over the life of the loan, our efforts to pay off this mortgage will be sabotaged to the extent that we’ll pay a whopping $71,869.51. This balloons the total price tag of Home-Sweet-Home to $171,869.51!

This is 71.9% higher than the original purchase price, all that most people consider when evaluating whether or not they can afford a home.

“How would you like to pay for your house almost twice over?” – probably not something you’ll ever find in an ad from your friendly local real estate agent or mortgage lender.

Cracking The Compound Interest Code

Compound interest can serve as both a dependable asset and a formidable foe, depending on which side of the savings vs. debt war you are on.

Projecting the extent to which compound interest will work against you prior to purchasing something on credit is essential in order to understand true costs and make fully-informed purchasing decisions.

In the above example, the couple considering the $100,000 mortgage may very well have altered their home-shopping budget had they known the true price tag would amount to $171,869.51.

Understanding the impact that compound interest can have to hinder your efforts to achieve financial freedom is one of the most important elements to crafting an effective financial plan that supports your ideal lifestyle.

Know Your Enemy: A Face-to-Face Meeting

The average American loses $279,002 to interest payments over their lifetime. Take some time to experiment with the subterfuge capabilities of compound interest by using the below calculators and numbers from your own financial situation:

- Compound Interest Calculator – Use to calculate the growth of a starting balance over time at a given interest rate (select “View Report” for year-by-year details).

- Debt Payment Principal & Interest Calculator – Use to calculate what portion of a debt payment is applied to principal vs. interest based on loan balance and interest rate.

- Credit Card Payoff Calculator – Use to view credit card payoff timeline, total interest incurred, and principal vs. interest portions of payments.

- Mortgage Loan Amortization Schedule Calculator – Use to calculate the total interest owed over a given mortgage term, as well as the impact of making additional payments (select “show amortization schedule” for year-by-year details).

Up Next – Compound Interest, Part 4: The Hidden Opportunity Cost Of Debt

*Note: If you are a Bond addict or a World War II, military history, or espionage buff, you can read more about Dusko Popov by checking out “Into The Lion’s Mouth: The True Story of Dusko Popov: World War II Spy, Patriot, And The Real-Life Inspiration For James Bond” from your local library. You can find reviews for the book on Amazon.

This is probably the most interesting post I’ve read all week! I love how you correlated it with James Bond. I had no idea he was based off a real guy!

The mortgage though… It is that spreadsheet you show up there that now terrifies me from buying a house. It makes me realize that without a down payment and a 15-year loan, you’re losing on your home almost every time!

Glad you liked it, Liz! I only learned of Dusko Popov and the 007 back-story a few years ago myself. Fascinating stuff.

While terrified might be a bit more than what I was shooting for, my goal with the article was to help portray the true danger of compound interest when it’s allowed to work against you.

Too many people jump into mortgages without evaluating the true costs simply because of social norms. Everyone has or knows someone who has a mortgage. And for that reason, the danger a mortgage poses to long-term wealth often flies under the radar during the purchase process.

We’ve rented before, and purchased our current home with a mortgage. There are pros and cons both ways. The mortgage allowed us to afford a home a handful of years earlier than we otherwise could have if we would have needed to save up the cash to purchase it, but for that privilege we paid some loan interest.

The key to home buying is running a loan amortization calculator when setting your home shopping budget. This will help you determine how much of a penalty in loan interest you’re willing to pay for the privilege of purchasing a home you can’t afford outright. It will also help you see the huge impact of shortening the loan term and making extra payments.

Evaluating both purchase price and interest over the life of the loan will inform your purchase decision far better than simply price tag alone. We bought our house with the plan to pay it off in three years, so we knew the extent interest could work against us would be quite limited. Thankfully, we managed to escape mostly unscathed. But had we let our 15-year mortgage run full-term, our house would have been far, far more expensive.