Beat Murphy’s Law With… The Classic Car Emergency Fund Model

Murphy’s Law – Anything that can go wrong, will go wrong. We all know this old adage. And I’d wager that most of us have lived it and can lustily vouch for its accuracy.

The insurance industry is predicated almost entirely on this concept. There are at least 95 policy types that exist – life, health, home, auto, motorcycle, boat, accidental death and dismemberment(!?!), travel, liability, flood, kidnapping, alien abduction… the list goes on.

And while hopefully your chances of being dismembered or abducted by aliens are excruciatingly low, just remember that Murphy is still out there.

So the question becomes, how do you Murphy-proof your finances? I submit that you can do so by copying a design element dating back to the early days of “the motorcar”.

Table of Contents

- 1 Murphy’s Law – The Total Depravity Of Inanimate Things

- 2 The Classic Car Emergency Fund Model

- 3 The Key To Beating Murphy’s Law

- 4 A Road Trip Lesson On Preparing For Emergency

- 5 Your Emergency Fund Spare Tire

- 6 The Surprising Side Effect Of Our Emergency Fund

- 7 Packing Your Emergency Fund Spare

- 8 Next Steps

Murphy’s Law – The Total Depravity Of Inanimate Things

If you’ve ever woken up late for work because your alarm didn’t go off, only to find that your keys have disappeared, your car battery is dead, and the clamps on your battery charger or jumper cables have stripped and been rendered unusable, you know the frustration of dealing with Murphy’s Law.

If you feel that you’ve had more than your fair share of run-ins with Murphy, just know that you’re not alone. According to Wikipedia, the concept of Murphy’s Law may be as old as humanity itself. An early 20th-century British Magician was so infuriated by a series of events attributable to Murphy’s Law that he described it as follows:

“The total depravity of inanimate things.” – British Magician Nevil Maskelyne, 1908

Things going awry is a fact of life. And when they do we can choose to either laugh or cry, as the saying goes. A comedian named Paul Jennings unsurprisingly chose the former, and created the term “resistentialism” to refer to the seeming intentional effort of inanimate objects to resist the will of humans. Here’s the definition:

“Seemingly spiteful behavior manifested by inanimate objects… exhibiting a high degree of malice towards humans.” – Humorist Paul Jennings, 1948

Ever innocently walked by your couch only to painfully stub your toe on it? Received a sliver from a surface that previously seemed smooth as silk? Wrestled with an unruly garden hose? These are perfect examples of resistentialism, the practical application of the concept behind Murphy’s Law.

The Many Expensive Faces Of “The Resistance”

Murphy’s Law and resistentialism can join forces to cause havoc in a large number of potentially very expensive ways. Your clothes washer spins itself into oblivion. The lawn tractor goes kaput. Your car breaks down. The roof starts leaking. Your windshield gets cracked by a rock, impairing your vision behind the wheel.

The fridge gives up the ghost. The computer you use to work from home inexplicably dies. The television falls off the wall or topples over. The plumbing starts to leak. You trip on an electrical cord and break a bone, requiring surgical repair. This is all just Murphy waving hello.

A recent BankRate study found that the average unexpected expense runs about $2,500. It also found that Murphy struck 34% of households last year with such an expense and that 61% of Americans do not have enough in savings to cover a $1,000 emergency.

Are Financial Emergencies Adding To Your Damage Control Stress?

The question isn’t whether something will fail, break, or quit, it’s a matter of when. And when it does, you’ll have your hands full with damage control.

Arranging for rides to/from work if your car broke down, researching and sourcing replacement parts, reading reviews on and shopping for a new appliance, performing necessary repairs, dealing with a medical emergency, the list goes on.

The very last thing you want to be worried about when getting your life back on track is whether you can pay for whatever it is that you need. You don’t need a financial emergency on top of whatever other emergency Murphy has left you with.

Are You Using Credit Cards To Make Bad Situations Even Worse?

I don’t have any hard stats on exactly how much credit card debt is a direct result of Murphy’s Law. But we do know that 39% of Americans have no savings at all, 61% have less than $1,000 put away, and up to 78% report living paycheck-to-paycheck.

That means the plastic in their wallet or purse is the likely the only way for the majority of Americans to pay for cleaning up Murphy’s mess. Unfortunately, doing so simply creates a financial emergency on top of your original headache thanks to the compound interest double agent and the hidden opportunity cost of debt.

The Classic Car Emergency Fund Model

There’s a better way to deal with unforeseen expenses. One which doesn’t involve stressing over how to pay for necessary bills or repairs and one which won’t force you into debt. The right approach can even eliminate your financial emergencies for good.

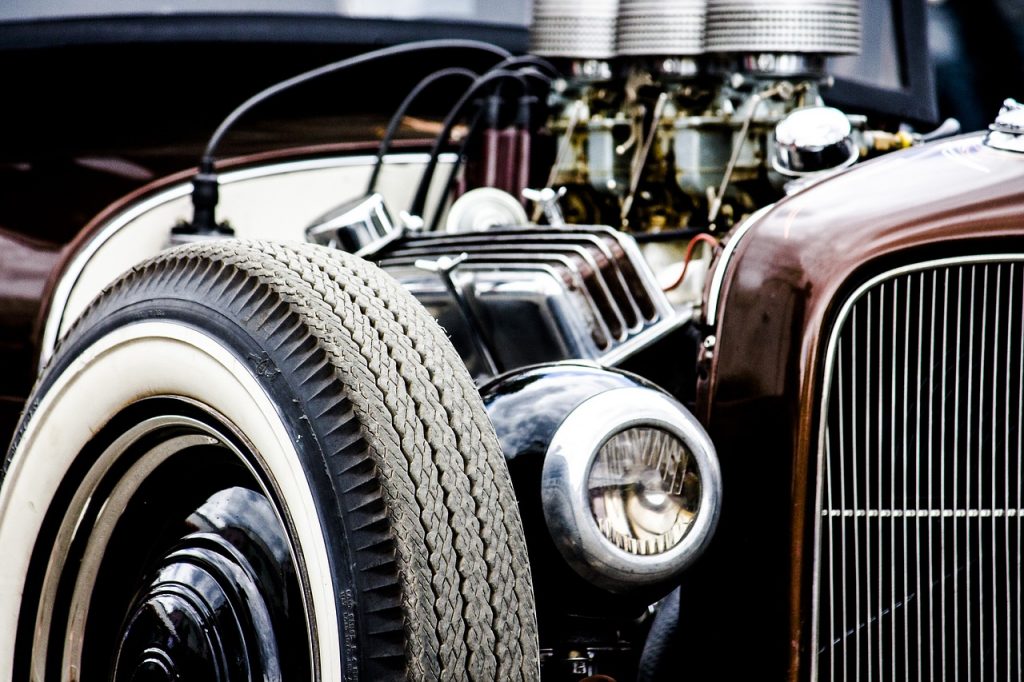

The answer is illustrated in the basic design of the early automobile. Take a look a the motorcar in the below photo. What stands out to you the most as being different from today’s designs?

If the tires drew your attention, you’re in the right neighborhood. Specifically, if the spare tire mounted to the fender was your answer, you’d be correct. This was standard protocol for the period, which brings a smile to the face of this utilitarian. Compare and contrast this with the 28% of 2017 models which did not come with a spare.

The Key To Beating Murphy’s Law

You might be wondering what on earth a 1930’s-era spare tire has to do with finances. Well, think about the purpose of the spare for a minute. It is intended to mitigate the unfortunate circumstances of a blown or flat tire by equipping the driver in advance with what they need to overcome a bad situation in future.

No driver knows exactly when they’ll suffer a punctured or blown tire. But what we do know is that it can happen at any moment. And thanks to Murphy’s Law, it will happen sooner or later.

You may not be able to prevent the effects of Murphy’s Law from taking place, but you CAN prevent them from putting you in a state of financial emergency. The key to beating Murphy’s Law is to acknowledge its validity and to prepare for its effects in advance.

A Road Trip Lesson On Preparing For Emergency

Road trips are one of my wife and I’s favorite types of vacations. Just a year-and-a-half ago, we had the privilege of road-tripping and car-camping all over the Pacific Northwest.

Our itinerary took us north from Seattle to North Cascades National Park; east across Washington and Idaho to Montana’s Glacier National Park; back west through Washington’s fruit-laced Yakima Valley to the iconic Mt. Rainier, the hanging moss gardens of the Olympic Peninsula, and Mt. St. Helens; south to Portland, Oregon and the orchards and vineyards of the Columbian River Gorge; south along the scenic Oregon Coast; and east to Crater Lake and the ruts of the Oregon Trail in the wilderness of Eastern Oregon.

In all, we traveled nearly 5,000 miles in our rental car over a span of just 16 days. One of the most remote stretches on our entire trip was the eastern two-thirds of northern Washington State. This is treeless country, with nothing but vast wheat fields and rolling hills as far as the eye can see.

In a bold move to stay on track with our aggressive itinerary, we elected to drive east the length of Washington State to an overnight stop in Spokane after a long day of sightseeing and hiking in the Cascades. I was pretty fatigued behind the wheel, and Mrs. FFP had to keep me awake by feeding me an unending stream of animal crackers for several hours. The struggle was real.

Our gas-saving, interstate-free route combined with the hour and the location to make us virtually alone on the road for hours. We pulled over occasionally so I could get out, stretch my legs, and let the night air wake me up. I still remember the feeling of being virtually alone under the moon.

Your Emergency Fund Spare Tire

Like a spare ready and waiting to take the place of a flat, a savings account balance dedicated to serving as a resource for emergencies can keep a bad situation from becoming far worse.

While thankfully we didn’t have car trouble on the remote leg of our road trip through the Pacific NW, we did have a spare tire, jack, and lug nut wrench in the trunk. Had we blown a tire, we would’ve been back on the road in 15-20 minutes.

But if we would have blown a tire and been without a spare, our situation would have been far, far worse. No cell reception, no passing traffic, nowhere near a town. Even had we been able to finally flag someone down, we would have had to arrange for a very expensive tow.

And the balance of our road-trip itinerary complete with prepaid reservations likely would have been out the window. We would have been extremely stressed, frustrated, and quite possibly bitter that all of our planning and saving for this trip would have been for naught.

Don’t tempt fate and endanger your financial freedom journey by traveling without the financial equivalent of your own spare tire. Create an emergency fund and save yourself the unnecessary frustration, stress, and expense of being unprepared when an unforeseen expense presents itself.

Sizing Your Emergency Fund

You can’t throw just any spare tire on a vehicle and expect it to fit. A tire of the wrong size or bolt pattern won’t do you much good. Similarly, if you want to eliminate your financial emergencies permanently you’ll need to make sure your emergency fund is sized correctly.

The conventional advice is that your emergency fund be large enough to cover a basic range of 3-6 months worth of your living expenses. The logic here is that in case of job loss you’ll have enough savings to get by until you land a replacement.

But you’re not here for conventional advice, are you? Homeowners are often better off with a larger fund to help protect against expenses for which renters would not be liable. This can include things such as HVAC system or major appliance failure and roof replacement or repair.

And you need to ensure that your fund is large enough to handle the sum of the deductibles on your home / renter’s and auto insurance policies, in addition to the out-of-pocket max on your health insurance policy.

The ideal size of your emergency fund is up to you, as long as you keep the above factors in mind. Just be aware that a too-small emergency fund means you’re living on the edge. And setting aside too much means you may be foregoing more lucrative ways to use your savings.

The Importance Of Emergency Fund Availability

Even if sized properly, a spare tire isn’t of much use if you don’t have a lug nut wrench and jack on hand to install it. Similarly, your emergency fund won’t be of much use to you if you don’t ensure that it’s readily available.

If emergency arises you will need to have ready access to your savings. This means your emergency fund shouldn’t be invested in stocks, bonds, or real estate. It also shouldn’t be tied up in a Certificate of Deposit, unless it’s of the no-penalty variety.

The ideal place for an emergency fund is in an easily-accessible high-yield savings or money market account. Most of these accounts are offered by online-only banks. Since savings accounts don’t come with debit cards or checkbooks, this poses a bit of a challenge in terms of gaining immediate access to your cash.

The Logistics Of Storing Your Emergency Fund

There are several options and strategies regarding where to store your emergency fund:

1) Keeping cash at home makes it easily accessible, but by doing so you create a security risk and give up any and all potential interest earnings.

2) A savings account at your local bank is typically fairly accessible, unless your emergency takes place over a weekend and you don’t have direct ATM access to the account. You may not obtain the best interest rate, either.

3) A high-yield savings account at an online bank paired with a checking account at the same institution can prove a good system. Online transfers can typically be made between accounts instantly, even over holidays and weekends. You can then use your checking account debit card or checks to pay for emergency expenses.

4) If you have a credit card with a credit limit that meets or exceeds your emergency fund balance, you can charge emergency expenses to your credit card when encountered. You then have the remainder of the statement cycle to transfer your savings from an online bank or no-penalty CD to your checking account.

Whatever strategy you pursue, you need to ensure that your emergency fund is as readily available as a fender-mounted spare tire.

The Surprising Side Effect Of Our Emergency Fund

When Mrs. FFP and I were first married, we had no emergency fund. We quickly saved up three months of basic living expenses, then upped our goal to six months. Once we purchased our first home a year or so later, we increased our goal to a year’s worth of living expenses.

I had planned to include in this article a list of the financial emergencies that these savings have helped us avoid over the last eight years. However, after racking my brain for some time I found that I was drawing a blank. Nothing stood out.

I knew we couldn’t have simply escaped Murphy’s Law entirely during this span, so I consulted Mrs. FFP on the matter. Somewhat astoundingly, she came up empty as well. Then it dawned on me. The mere presence of our emergency fund had served to completely prevent any and all financial emergencies over the last eight years.

Sure, we’ve had situations come up in that span that easily COULD have constituted financial emergencies. There was the birth of our first child, which didn’t go as planned and cost thousands of dollars more than we had expected. There were the two ER visits and related surgeries to repair sports-related injuries, along with time off of work to recover.

Then there was that time the engine in the riding lawn mower conked out right at the start of spring green-up, forcing us into the market for a $1,000+ tractor unexpectedly. And we’ll never forget that time the furnace quit on the coldest day of the year, leaving us to huddle around a small space heater for the better part of two weeks.

Eradicate Your Financial Emergencies For Good

Thee above situations (and many others) could have easily constituted financial emergencies. But they didn’t, because our emergency fund simply enabled us to cover the expense without worry while focusing our energy and effort on the non-financial elements of each situation.

This is the secret power of an emergency fund. It’s hard to explain the level of security that a properly sized emergency fund provides. The mental picture of my young son fast asleep without a care in the world comes to mind.

Packing Your Emergency Fund Spare

An emergency fund can help you avoid financial emergency, de-stress your financial life, and circumvent the wealth-killer of credit card debt. Sizing and packing your emergency fund spare tire represents a big step towards financial freedom.

But before you pop that trunk, be aware that you may not currently be in the best position to take this step. For example, if you have credit card debt you will likely be better off to pay down this debt prior to starting an emergency fund.

The next several articles in this series will help you identify all of your personal savings goals and prioritize them in the most strategic and efficient manner possible. We’ll work on actually creating your emergency fund later on, but the details on doing so are listed below.

Extra Bonus – No discussion of early 20th-century automobiles would be complete without a mention of the classic “Chitty Chitty Bang Bang” film starring Dick Van Dyke. The movie is not only an entertaining and family-friendly watch, but it features many different types of early 20th-century cars all sporting the classic fender-mounted spare. You can likely find it at your local library or on Amazon.

Next Steps

If you’ve been following the Master Your Money series from the beginning, you’re currently in the process of establishing savings goals in your monthly budget. The steps below outline how to calculate the required size of your emergency fund savings goal:

- Determine what level of security makes you the most comfortable in terms of months of living expenses saved in case you were to lose your job.

- Check your Budget Scoreboard in Mint Budgets to review your total monthly spending. Since the only budgets you’ve created so far are for bills and non-discretionary spending, this amount represents your minimum monthly expenses.

- Multiply this budget total from Mint by the number of months worth of expenses which you find ideal. This number represents your initial emergency fund savings goal.

- Look up the deductible on your home or renters insurance policy and add it to the above total.

- If you own one or more vehicles and carry comprehensive or collision insurance, identify the largest deductible for each vehicle on your policy and add it to the above total.

- If you own one or more vehicles necessary for your daily commute but do not carry full coverage on them, add the expected costs of full repair or of purchasing a replacement for each to the above total.

- Identify the listed out-of-pocket maximum on your health insurance policy and add it to the above total.

- If you are a homeowner, consider the potential costs of replacing your kitchen or laundry room appliances, water heater, water softener, HVAC system, or roof. Account for needing to potentially replace one or more of these items in your total.

Haha, I love the analogy! As a huge proponent of emergency funds, this is right up my alley 🙂

Thanks, Mrs. AR! The concept of an emergency fund is not a new one by any means, but it’s important enough that I still wanted to address it and share our experience using one. Now to find that alien abduction insurance rider… #murphyisalwayslurking

Great analogy and a great story telling. I can’t think of anything else to add to this or a better way to explain the importance of an emergency fund. I will say though, I was shocked that over 27% of cars come without a flat tire though….that’s ridiculous. In the end, it just makes sense. You’re right, these expenses will come and you need to be prepared. We preach financial stability, building investments, early retirement, etc., but having this fund that you can dip into when things don’t go as planned is crucial to having the peace of mind that fuels the classic car emergency fund. Thanks for the great read tonight!

Bert

Thanks for the kind words, Bert! I had a lot of fun putting this article together. I’m glad you enjoyed it! I too was shocked to learn that over a quarter of new car designs do not include a spare. Good thing I have 10-15 years to hit upon a solution… 🙂

Gee, I hope 100% of cars come without flat tires…

One can only hope! But given the fact that new car sales involve a stealersh… I mean, dealership, I’d put those chances at less than perfect, given anecdotal evidence. 😉

Fantastic way to relate the emergency fund. It is hard to exactly spell out the flexibility that having a sufficient emergency fund provides and you did it really well. Thanks for sharing!

My pleasure, Ryan! Thanks for commenting!

we still keep some cash in the house which we don’t touch in case of emergency like when the power may be out an extended period. we set our fund at 10k about 14 years ago but keep our travel/gift/repair bucket in the same account. i write down the amounts each week, old school. i like having the repairs and vacation money in the same bucket so when you have to lay out a few thousand for something big you can just travel less until that part is back up. like y’all, we have’t officially touched the “emergency” part in all 14 years so far. and that includes some bruisers. nice article.

I keep a health balance of hotel points in case of an extended power outage, and always at least 1/2 tank of gas – within a 100 mile radius, the power may be on and you can stay elsewhere for a while.

That’s an interesting concept. I applaud you for thinking that far ahead! I think if our power were to ever go out for an extended period of time, we’d probably just hunker down and wait things out at home. I think it more likely we’d have what we need here rather than at a hotel, and there’s always the power of community as well.

That said, I still have an old-school hand-operated pump on my wish list that is compatible with standard kitchen sink supply line plumbing for access to drinking water in the absence of power (we’re on well water as opposed to city water). Thanks for the reminder!

Fill a tub before big storms and keep a bucket handy – at least you could flush the toilets.

Me too on the hotel points. I also know which nearby counties have rec centers/health clubs where you could pay a daily fee to take a shower. Police safety seminars always recommend 1/2 tank of gas or more. It also helps to make friends with some doomsday preppers.

I’ll second the befriending preppers strategy. As an aside, if any readers are interested in learning more about the intersection of prepping and financial independence, check out my pal OthalaFehu’s blog. This guest post he authored is a sample of what you can expect.

Thanks for sharing, Freddy! I’m sure you’ve weathered your fair share of visits from good old Uncle Murph over those 14 years, and it sounds like your level of preparedness is on point.

$10K is a healthy chunk of change! While the true measure of emergency fund adequacy isn’t a fixed amount but a function of spending, that amount of savings alone puts you in rare company statistically. Well done, sir!

Mrs. FFP and I don’t keep significant cash at home due to concerns regarding security and lack of return, but we do have a generator that can provide emergency power.

We use individual savings accounts for all of our dedicated sinking funds rather than keeping one account with everything lumped together. We find it easier to track the balances in each account that way, and since the accounts are all held at the same institution, transfers between accounts are instant. We’re all about simplicity and automation!

My only quibble is calling Murphy’s effects “unexpected.” They’re largely ignored and treated with denial instead of being anticipated. If you only have 1 of something which is genuinely critical, then you need to ponder and plan for its unavailability or replacement. This is also true for people (upon whom you may depend for what they do and income they provide). Taking the spare tire metaphor one step further, the false sense of security of run-flat tires must be carefully weighed against their exorbitant replacement cost. What’s a new or used fridge, car, digital device, or any wear-and-tear item going to cost you? How quickly will you need it? Can you live without it – temporarily or permanently?

Anticipating the eventual need to replace wear items will definitely help keep you a step ahead of Murphy. For example, I usually order enough deck belts for my riding lawnmower to ensure I always have a spare on hand. And we always maintain spare light bulbs and batteries for household use as well.

Larger items like roofs, HVAC systems, kitchen appliances, and vehicle maintenance can all be anticipated and budgeted for in advance as well via the use of sinking funds. And as you point out, proper planning even extends to things like life insurance.

But not all of Murphy’s antics can be anticipated. For example, just in the last month our Master Bath garden tub plumbing sprung a leak, an exterior hose bibb vacuum breaker went bad, the muffler on our riding lawnmower broke, and a freak lightning strike fried the motherboard on our home PC despite basic precautions having been taken to avoid that possibility.

None of the above acts of Murphy could have been necessarily foreseen or expected. The premise of this article is to therefore acknowledge the validity of Murphy’s Law and financially plan in advance for the unexpected and unforeseen.