Flee The Robber Barons: Avoiding Exorbitant Bank Fees

In early medieval history, some feudal landowners turned their hand to lowbrow tactics to supplement their income. Their insidious acts ranged from merely charging excess tolls to highway robbery and even kidnapping for ransom. Such scoundrels gave rise to the term “Robber Baron“.

While unfortunate, you may think that this tale of highway banditry perpetrated hundreds of years ago doesn’t concern you. But I’m here to tell you that it does.

Because there’s a modern-day robber baron afoot, masquerading as your friendly bank. Exorbitant bank fees are the new highway robbery. And if you’re not careful, you’ll find yourself being relieved of your hard-earned cash faster than a waylaid medieval merchant.

Table of Contents

The Rise Of The Medieval Robber Baron

The Rhine River flows from the Swiss Alps through Germany and the heart of Europe before emptying into the Atlantic via the North Sea. Prior to the invention of modern transportation, it served as a virtual economic highway for the transportation of goods.

So much so, in fact, that tolls were collected from ships traversing the Rhine for a period of a thousand years under the reign of the The Holy Roman Empire, spanning 800-1800 AD.

The location and rates of the tolls levied were authorized and established by the Holy Roman Emperor himself. But from 1250-1273 AD, the throne of the Holy Roman Emperor sat vacant. This period became known as “The Great Interregnum”.

The lack of central authority during this period empowered unscrupulous Germanic nobles to begin charging more and higher Rhine River tolls than those previously authorized. In some cases, they even resorted to pure robbery of ship cargo. According to Wikipedia, this is what first gave rise to the term “Robber Baron”.

The Highway Robbery Of Bank Fees

Overdraft fees. ATM fees. Minimum Balance Fees. Transaction Fees. Inactivity Fees. Paper Statement Fees. Lost Debit Card Fees. Foreign Transaction Fees. Account Maintenance Fees. Returned Deposit Fees. The list of bank fees is long. And the fees themselves are growing.

CNBC reports that ATM fees have gone up for 10 consecutive years. ATM fee revenue for JPMorgan Chase rose by 22% in 2016 alone thanks to a fee increase.

Overdraft fees paid by consumers increased 3% in 2017 to $34.3 BILLION thanks in large part to fee increases at credit unions. The average overdraft fee charged by banks is now $30, up 50% from $20 in 2000. Credit unions now charge $29 on average, nearly double the $15 rate in 2000.

Would you believe that there is currently no central authority which regulates, restricts, or oversees the fees that banks can charge for deposit accounts? Thanks to the Great Interregnum, we know how this story ends.

Much like robbery on the Rhine in the Middle Ages, bank fees are currently big business. For proof of this, look no further than this Bank Fee Finder – April 2017 Report slideshow put together by Chime Banking:

Fee-Fi-Fo-Fum. I smell the blood of a Englishman Robber Baron.

The Long-Term Cost Of Bank Fees

The 2017 survey performed by Chime Banking found that the average American loses $329/year ($27.42/month) to bank fees. To put that in perspective, that’s more than the annual subscription costs of Netflix (Basic Plan – $95.88/year), Hulu (Basic Plan – $95.88/year) and Amazon Prime ($119.00/year), combined.

Think that’s not so bad? $329/year x an adult lifespan of 60 years is $19,740. A pretty penny in it’s own right. But that’s chump change compared to the cost of those fees once the power of compound interest is factored in. After all, if you weren’t losing that $329/year to bank fees, you could have invested it instead.

This calculator indicates that an investment of $329/year for 60 years would grow to $305,447 at the average historical market rate of return of 7%. Add this to the $19,740 in bank fees paid over a typical adult lifespan, and you have a grand total of $325,187.

This is no small pilfering scheme, but full-fledged highway robbery.

How Much Are You Losing To Bank Fees?

Studies have shown the average American loses about $329/year to bank fees. And as we saw above, this translates to a total cost of approximately $325,000 over a span of the typical adult lifetime once lost growth is factored in.

That’s the average. But how much are YOU paying in bank fees? You might be thinking there’s no way you pay $329.00 every year. The good news? You can find out, one way or another, right now.

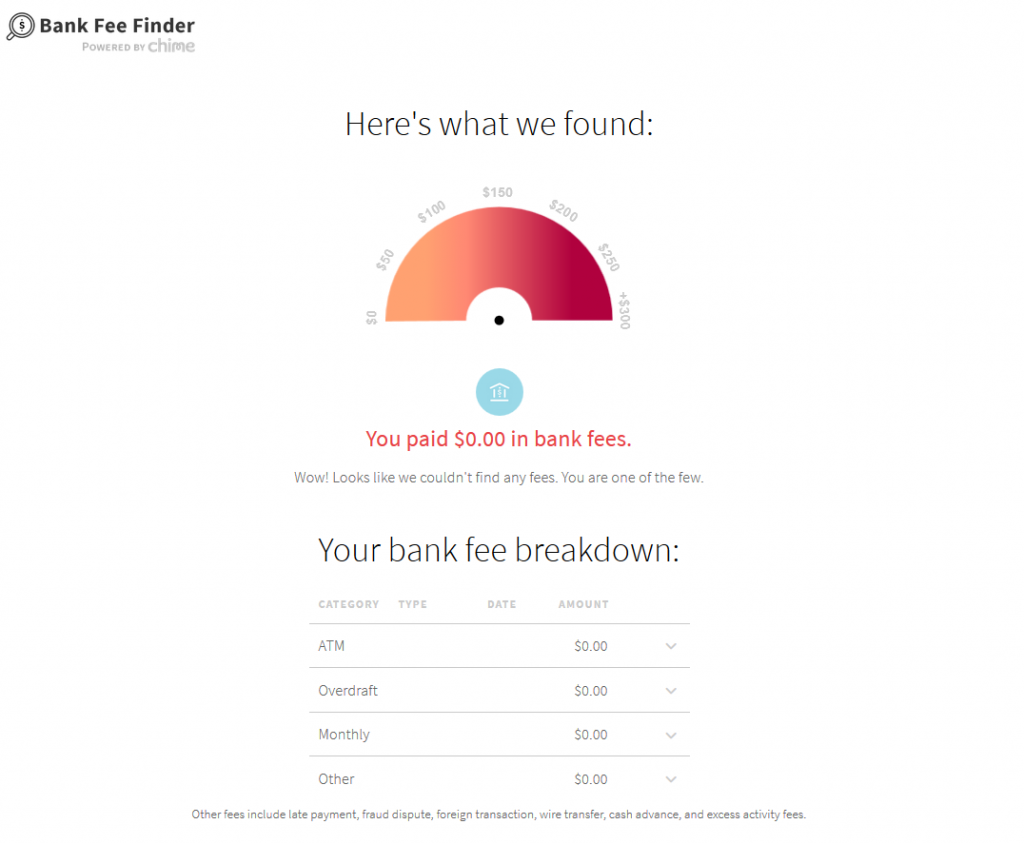

Chime’s Bank Fee Finder will tell you exactly how much you’re paying annually in bank fees. The tool works similarly to Mint in that it uses online banking credentials to sync with your accounts. It uses this information to scan for and tally up any and all fees paid. Your login information isn’t stored, access granted is read-only, the inquiry won’t affect your credit report, and your information isn’t shared with any third parties.

I used the tool to scan my own accounts. After opening the custom report which was sent to my email address, I found that I’m one of the few not losing any money to bank fees (more on why below):

Perform your own checkup and see how much of your hard-earned cash is filling bank coffers.

How To Avoid Bank Fees

Below are some temporary countermeasures you can take to avoid the highway robbery of bank fees:

- Locate your bank’s fee schedule and educate yourself on what activities or scenarios will incur fees.

- Check for the presence of a paper statement fee and consider enrolling in paperless statements to avoid it.

- Combat overdraft fees by configuring Mint account balance email and text alerts to notify you when your account balance nears zero.

- Avoid minimum balance fees by configuring Mint account balance email and text alerts to notify you when your account balance nears this point.

- Check to see whether you are enrolled in overdraft protection services. If you’d rather deal with the minor inconvenience of your debit card getting declined in an insufficient funds situation than face a $30-$40 overdraft protection fee (usually per overdraft instance), consider opting out of the service.

The Excess Tolls Of Low Interest Rates

As if the highway robbery of bank fees wasn’t bad enough, many of today’s banks also sell you short in the form of grossly low interest rates paid on deposit accounts. And your friendly local bank might be one of the worst offenders.

You might be scratching your head over this one. Aren’t low interest rates a GOOD thing?

Only if you’ve been successfully conditioned by the banking industry to view interest rates from the perspective of a borrower rather than a saver. A low interest rate on a loan like your mortgage, credit card, auto loan, or student loan is in fact a good thing, as it means loan interest won’t undermine your finances quite as quickly. But a low interest rate on your savings or investments is NOT a good thing, as it slows the acceleration of your rocket to riches.

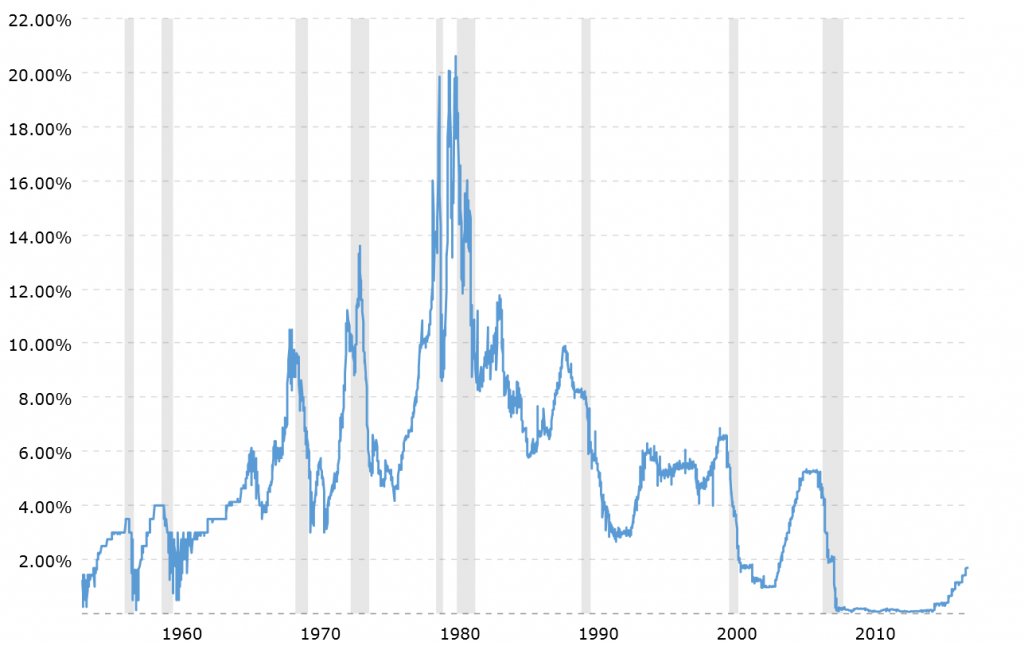

The interest rates on financial instruments like mortgages, CD’s, and savings accounts are a function of the Federal Fund Rate, which is the interest rate at which banks and credit unions lend each other money overnight. You can find the full history of the fed funds rate via the chart below:

Recessions are shown in grey. Notice how they coincide with massive cuts in the fed funds rate? Interest rates are intentionally lowered in times of recession to spur borrowing and spending as a means of creating economic investment and growth. This is great for borrowers taking on new debt, but not so great for savers.

How Much Is Your Bank Underpaying You?

The incredibly low fed funds rate for the protracted period since the Great Recession of 2008 is unprecedented. It’s been under 2% for the last decade. The rate was as low as .07% in August of 2013, and has only recently begun to increase again. According to Macrotrends, the current Federal Interest Rate is 1.70%. A tough time to be a saver.

But as the fed funds rate has increased, some banks have been intentionally slow to pass on the interest rate increases to holders of savings accounts or Certificates of Deposit. For example, my local bank offers only a .04% interest rate on savings accounts. This is nowhere near the current fed funds rate of 1.70%.

Such an underpayment can cost you dearly. A simple $1,000 emergency fund earning .04% interest annually would earn just $21.60 over a span of 60 years. But that same $1,000 at 1.70% interest over the same span would earn a total of $1,749.53, nearly tripling in value.

Much like the excess tolls levied by unscrupulous nobles on medieval merchants traveling the Rhine during the Great Interregnum, this difference effectively represents an excess toll on your ability to build wealth.

Why We Left Our Local Bank

I mentioned earlier that Chime’s Bank Fee Finder tool didn’t identify any bank fees for our accounts. That’s because we fled the robbery of our local bank years ago.

Here’s the story. Back when Mrs. FFP and I first set up dedicated savings accounts to enable us to avoid the unexpected bill scramble drill, we did so at our local bank. But the fact that our bank required a $100 minimum balance in each savings account to avoid a monthly maintenance fee made things difficult.

The entire concept of sinking funds is that they are intended to be emptied at some point in time. As a countermeasure, we seeded each account with an extra $100 to avoid the issue. But spread across all of our sinking funds, that ran close to an extra $1,000, just to avoid monthly fees.

To make matters worse, the piddly .04% interest rate on our savings irked me to no extent. I knew rates approaching 1% (at the time) were available elsewhere. As our liquid savings grew, this became more and more of an issue, as I was well aware of the compound interest benefits we were missing out on.

An accidental transfer that dropped us below the $100 threshold and incurred a fee in one account was the last straw for me. I spent a month or so researching high-yield online savings accounts, and the name of one online bank kept cropping up – Ally Bank. At the time, they offered an online savings account with an interest rate of approximately 1%, no minimum balance requirements, and no maintenance or transfer fees.

We opened an online savings account with them, created separate sub-accounts for our sinking funds, transferred our cash, and closed our savings accounts at our local bank. We’ve been happily banking with Ally ever since.

Our Current Banking Setup

Since Ally is an online-only institution, we didn’t completely ditch our local bank. We kept our primary checking account with them for the convenience of being able to deposit and withdraw money locally. This means we also retained access to their free coin-cashing and notary services.

Since we keep only enough money in the checking account to cover monthly cash flow needs, the low interest rate isn’t much of an issue. We also keep a small cushion in the account to protect against low balance and monthly maintenance fees.

When one of the bills linked to our dedicated savings accounts comes due, we simply transfer the funds from Ally to our local bank via online transfer. The transfer process is simple, free, and takes 1-3 business days. The other 362 – 364 days of the year, that money sits and grows at 1.60% interest, fee-free.

Ally Bank – A Refuge From Bank Fees

Our experience to date with Ally is limited to their online savings accounts. Though they do offer a range of CD’s with impressive interest rates and flexibility. And I’m constantly tempted to ditch our local bank entirely in favor of Ally’s Checking account.

Ally has raised our savings account interest rate SEVEN times over the last year and a half. As the fed funds rate has increased, Ally has passed on those interest rate savings to their customers. Our interest rate has climbed from 1.00% to 1.60%, while my local bank hasn’t budged their offering which is still stuck at .04%.

In the four years we’ve banked with Ally, I’ve been highly impressed with them. That’s saying something, because I’m usually not impressed easily. Using Ally’s online banking interface is easy, uncomplicated, and intuitive. More than can be said for most things today.

There’s not many companies I deal with who I consider excellent at what they do. Ally Bank is one of them. They’ve been a breath of fresh air in a world reeking of incompetence.

And it’s not just me. Ally is currently the #1 rated online bank overall in NerdWallet’s ratings. And thousands of actual consumers gave Ally a score of 93/100 in the 2017 Consumer Reports Online Banking Survey. You can find a list of the awards and accolades Ally has received over the years here.

Based on my own experience and recommendation, several of my family members and former coworkers have opened accounts at Ally. All of these individuals speak very highly of their services, as I do.

The Benefits of Ally Bank

So what features do we like best about Ally? Here’s a list:

- They are FDIC-insured, up to the maximum permitted by law

- You are not liable for unauthorized transactions if reported within 60 days

- Zero monthly or annual account maintenance fees

- Zero account inactivity fees

- Excellent online savings account interest rates (currently 1.60%)

- No minimum deposit

- Interest is compounded daily

- Instant transfers between Ally accounts

- Fee-free transfers to or from external accounts

- Ability to schedule recurring transfers

- Intuitive website user interface

- 24/7 live (U.S. or Canada-based) operators

- Email and chat support options

- Ability to deposit checks remotely

- Free Allpoint ATM access

- Reimbursement of up to $10 in non-Ally ATM network fees per statement cycle

- Online ATM and cash-back locator

- Free checks

How We Use Ally Bank

We keep our sinking funds and emergency fund in online savings accounts at Ally. The ability to schedule recurring transfers means this system is simple, easy, and on auto-pilot. We couldn’t be happier with it.

Moving these accounts to Ally four years ago has paid off in the form of our earning nearly $1,000 in interest beyond that which we would have made at our local bank during that same time. The absence of any and all fees is just the cherry on top.

Given Ally’s high savings account interest rates, lack of fees, and ease of scheduling recurring incoming and outgoing transfers to external accounts, I think they’re a perfect candidate for hosting your dedicated savings accounts and emergency fund as well.

I have no financial relationship with Ally Bank and do not benefit in any way if they gain additional customers. This is simply good, old-fashioned word-of-mouth advertising at its best. Ally has an excellent product which has made our lives better and easier, and I highly recommend it.

Identify A Safer Path For Your Cash

Safe and unhindered travel on the Rhine during the Middle Ages was critical to not only the success of local trade, but also to the survival and growth of many cities bordering the river. The interference of robber barons with trade on the Rhine during the Great Interregnum became such an issue that 100 cities eventually banded together to form the “Rhine League” to restore law and order.

The League pulled no punches, but formed a militia and stormed the castles of known robber barons. According to Wikipedia, the Rhine League was successful in capturing or destroying 10-12 such castles within the first three years after it was formed.

The militant approach won’t get you much today beyond a trip to your local police precinct. Thankfully, there is another, more peaceful option to resolve injustice affecting your finances.

Banks and credit unions abound, and provide a plethora of options for your banking needs. If you’re tired of paying exorbitant fees and excess tolls on your cash, you have the luxury of simply selecting a different bank. Doing so is the equivalent of medieval merchants choosing a safer route to their destination.

Find A Better Bank

There are so many banking institutions available nowadays that sorting through them all can be a real pain in the derriere. With this in mind, I’ve outlined some resources below which you may find helpful as you evaluate your own banking situation.

ValuePenguin has compiled an excellent list of the best banks of 2018 with plenty of detail and supporting information. And you can find NerdWallet’s top banking picks at this link.

The Consumer Reports Bank & Credit Union Buying Guide (no subscription required) provides a decent overview of evaluation criteria. For more specific information, reference the 2017 CR Bank Ratings and the 2017 CR Online Bank Ratings (subscription required).

Last but not least, Find A Better Bank offers an online tool which will enable you to compare and contrast the fee structures and interest rates offered by local banks in your area to popular online banks.

Flee The Robber Barons

Modern day banks are committing highway robbery by levying exorbitant bank fees. And like the medieval robber barons along the Rhine, they often exact an excess toll on your wealth by providing an unjust interest rate on savings accounts as well.

Don’t make my mistake of putting up with institutions which levy exorbitant fees and low interest rates on dedicated savings accounts. As outlined in this article, there are far safer and more lucrative routes to your destination. Do your future self a favor and protect your hard-earned cash by fleeing these robber barons.

Extra Bonus – Castles play an outsized role in Germany’s history, dating all the way back to the days of the Holy Roman Empire. You can view the 10 most picturesque castles still standing in Germany today by clicking here.

Unfinished Business

So why cover this topic of bank fees and bank interest now, at this point in the Master Your Money series? Because as you put the finishing touches on your new money management system, we have a bit of unfinished business to circle back to.

In Beat The Blitz: Avoid The Unexpected Bill Scramble Drill, you created budget categories and amounts for your irregular, non-monthly bills. But in the footnote linked to step 4 in the action item section, I mentioned that we would be creating the actual savings accounts for these bills later on in the series. This is that point!

In Beat Murphy’s Law With… The Classic Car Emergency Fund Model, we covered some criteria regarding emergency fund availability and logistics. You’re now ready to evaluate those criteria along with your available options and create a dedicated savings account for your emergency fund.

In A High Stakes Balancing Act: Mastering The Save vs. Spend Tightrope, we reviewed the importance of using monthly transfers to sinking funds to budget for large, non-monthly sources of discretionary spending like Christmas gift-giving and vacation. You’ll need to create dedicated savings accounts for these categories now.

I haven’t recommended you create these dedicated savings accounts until now to prevent you from opening such accounts at your current bank, only to then potentially close them and open other accounts elsewhere. Aside from this being an avoidable hassle, many banks charge early account closure fees.

You now have all the information you need to make an informed decision regarding where to stash your cash, so these are no longer concerns.

Next Steps

For those of you who have been following the Master Your Money series from the beginning, below are your next steps on the path to financial freedom:

- Use Chime’s Bank Fee Finder tool to discover the damage bank fees have done you over the past year.

- Check the fee schedule of your current bank for minimum balance, account maintenance, and account inactivity fees. All three of these fee types will impact dedicated savings accounts used for sinking or emergency funds. If present, explore other options for your new savings accounts.

- Check the interest rate your current bank offers on savings accounts. If it’s significantly less than the Federal Funds Rate (currently 1.70%), look elsewhere for your new dedicated savings accounts.

- Open savings accounts for the following at the institution of your choice:

- Each of your irregular, non-monthly bills.

- Your emergency fund.

- Each of your large, non-monthly sources of discretionary spending, like Christmas gift-giving or vacation.

- Transfer any existing savings account or emergency fund balances to your new accounts. Close any affected accounts at your previous banking institution at the same time, to avoid any minimum balance fees.

- After all transactions have posted and have cleared your previous accounts in Mint, mark them closed (in Mint).

We love Ally bank for savings accounts as well! Great way to stash cash 🙂

Aren’t they great? Shortly after publishing this article, the Fed raised the Fed Funds Rate. Ally responded by promptly increasing their savings account interest rate from 1.60% to 1.75%.

My local bank is still offering a “competitive” .04% rate on savings accounts, per the marketing on their website. SMH!

Great post. Ally Bank is one of the good guys. Everyone should periodically do an audit of the fees they are paying. Most people just think about the fees they pay on mutual funds. Banking fees also need to be considered.

Thanks for stopping by, Dave! Indeed, both Vanguard and Ally seem to be in a league (see what I did there?) of their own when it comes to putting the customer first. I use and love both.

I agree wholeheartedly with the concept of performing a regular banking audit to check for the presence of fees. The average American is losing some serious cash every year. $329/year or $325,187 over the typical adult lifetime if invested is no small potatoes.

I’ve got most of my cash in Ally as well – I think their rate is up to 1.75%, but by the time someone reads this it’ll probably be bumped up again!

I’ve also heard that when banks started using ATMs, they actually paid you to use them, since using an ATM is a lot cheaper for the bank than using a human teller.

You’re dead-on, Joe! Shortly after this article went live, the Feds raised the Fed Funds Rate and Ally responded with two interest rate hikes of their own – from 1.60% to 1.65%, then again to 1.75% where it sits today. Further proof of why Ally is so great!

I’d never heard that about ATM’s. Fascinating. Makes perfect sense, so I don’t doubt it. Thanks for sharing!

Very good read! I will have to look into Ally. Currently, I have a 360 savings account with CapOne that has a 1% interest rate.

Thanks, Peerless! You won’t regret reading up on Ally. There are a few banks I’ve found that offer slightly higher interest rates, but none that can match Ally when all the chips are on the table in terms of lack of fees, ATM fee reimbursement, free checks, and free ACH transfer capability.

SO true! The fees banks make are absolutely nuts. The sad trend too is that the large guys are buying up all the smaller community banks, making this even worse.

The failures of the big banks that caused the crash have led to the continued failures of community banks, but the big guys stay in business. I’ve heard great things about Ally, will have to look into them. I’m currently at my states credit union which is about the best you can get otherwise. Great post!!